FINANCIAL ACCOUNTING:TOOLS FOR BUSINESS

19th Edition

ISBN: 9781119493624

Author: Kimmel

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.4EYCT

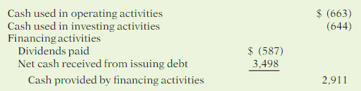

INTERPRETING FINANCIAL STATEMENTS

Xerox was not having a particularly pleasant year. The company’s stock price had already fallen in the previous year from $60 per share to $30. Just when it seemed things couldn't get worse, Xerox's stock fell to $4 per share. The data below were taken from the statement of

instructions

Analyze the information, and then answer the following questions.

- (a) If you were a creditor of Xerox, what reaction might you have to the above information?

- (b) If you were an investor in Xerox, what reaction might you have to the above information?

- (c) If you were evaluating the company as cither a creditor or a stockholder, what other information would you be interested in seeing?

- (d) Xerox decided to pay a cash dividend. This dividend was approximately equal to the amount paid in the previous year. Discuss the issues that were probably considered in making this decision.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Blossom Chemicals management identified the following cash flows as significant in its year-end meeting with analysts: During the

year Blossom had repaid existing debt of $316,800 and raised additional debt capital of $645,800. It also repurchased stock in the

open market for a total of $44,470. What is the net cash provided by financing activities? (If an amount reduces the cash flow then enter

with negative sign preceding the number e.g.-45 or parentheses e.g. (45).)

Net cash provided by financing activities

$

Mary Walker, president of Rusco Company, considers $27,000 to be the minimum cash balance for operating purposes. As can be seen from the following statements, only $22,000 in cash was available at the end of this year. Since the company reported a large net income for the year, and also issued both bonds and common stock, the sharp decline in cash is puzzling to Ms. Walker.

Rusco CompanyComparative Balance Sheetat July 31

This Year

Last Year

Assets

Current assets:

Cash

$ 22,000

$ 41,400

Accounts Receivable

229,800

219,100

Inventory

256,300

200,200

Prepaid expenses

11,900

23,400

Total current assets

520,000

484,100

Long-term investments

111,000

155,000

Plant and equipment

874,000

757,000

Less accumulated depreciation

213,500

192,100

Net plant and equipment

660,500

564,900

Total assets

$ 1,291,500

$ 1,204,000

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable

$ 237,700

$ 176,400

Accrued liabilities

8,700…

At the beginning of the year, the balance sheet of The Outlet showed $8 in the

common stock account and $138 in the additional paid-in surplus account. The end-

of-year balance sheet showed $20 and $232 in the same two accounts, respectively.

The company paid out $48 in cash dividends during the year. What is the cash flow

to stockholders for the year? Use a negative sign if the cash flow to stockholders

was negative. Do not use the $ sign in your answer.

Your Answer:

Chapter 1 Solutions

FINANCIAL ACCOUNTING:TOOLS FOR BUSINESS

Ch. 1 - Prob. 1QCh. 1 - Prob. 2QCh. 1 - Prob. 3QCh. 1 - Accounting is ingrained in our society and is...Ch. 1 - Prob. 5QCh. 1 - Prob. 6QCh. 1 - What are the three main types of business...Ch. 1 - Prob. 8QCh. 1 - Prob. 9QCh. 1 - Prob. 10Q

Ch. 1 - Prob. 11QCh. 1 - What are the three main categories of the...Ch. 1 - Prob. 13QCh. 1 - Prob. 14QCh. 1 - Prob. 15QCh. 1 - Which of these items are liabilities of White...Ch. 1 - How are each of the following financial statements...Ch. 1 - What is the purpose of the management discussion...Ch. 1 - Prob. 19QCh. 1 - Prob. 20QCh. 1 - Prob. 21QCh. 1 - Prob. 1.1BECh. 1 - Match each of the following types of evaluation...Ch. 1 - Indicate in which part of the statement of cash...Ch. 1 - Prob. 1.4BECh. 1 - Prob. 1.6BECh. 1 - Indicate which statement you would examine to find...Ch. 1 - Prob. 1.8BECh. 1 - Prob. 1.9BECh. 1 - Prob. 1.10BECh. 1 - Prob. 1.11BECh. 1 - Prob. 1.1DIECh. 1 - Prob. 1.2DIECh. 1 - Prob. 1.3bDIECh. 1 - Here is a list of words or phi uses discussed in...Ch. 1 - Prob. 1.4ECh. 1 - Prob. 1.9ECh. 1 - Prob. 1.12ECh. 1 - Prob. 1.19ECh. 1 - Prob. 1.21ECh. 1 - Prob. 1.1APCh. 1 - Financial decisions often place heavier emphasis...Ch. 1 - INTERPRETING FINANCIAL STATEMENTS Xerox was not...Ch. 1 - Prob. 1.5EYCTCh. 1 - Prob. 1.9EYCTCh. 1 - Prob. 1.10EYCTCh. 1 - Prob. 1.1IPCh. 1 - Prob. 1.2IPCh. 1 - Prob. 1.3IP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lucas Hunter, president of Simmons Industries Inc., believes that reporting operating cash flow per share on the income statement would be a useful addition to the companys just completed financial statements. The following discussion took place between Lucas Hunter and Simmons controller, John Jameson, in January, after the close of the fiscal year: Lucas: Ive been reviewing our financial statements for the last year. I am disappointed that our net income per share has dropped by 10% from last year. This wont look good to our shareholders. Is there anything we can do about this? John: What do you mean? The past is the past, and the numbers are in. There isnt much that can be done about it. Our financial statements were prepared according to generally accepted accounting principles, and I dont see much leeway for significant change at this point. Lucas: No, no. Im not suggesting that we cook the books. But look at the cash flow from operating activities on the statement of cash flows. The cash flow from operating activities has increased by 20%. This is very good newsand, I might add, useful information. The higher cash flow from operating activities will give our creditors comfort. John: Well, the cash flow from operating activities is on the statement of cash flows, so I guess users will be able to see the improved cash flow figures there. Lucas: This is true, but somehow I think this information should be given a much higher profile. I dont like this information being buried in the statement of cash flows. You know as well as I do that many users will focus on the income statement. Therefore, I think we ought to include an operating cash flow per share number on the face of the income statementsomeplace under the earnings per share number. In this way, users will get the complete picture of our operating performance. Yes, our earnings per share dropped this year, but our cash flow from operating activities improved! And all the information is in one place where users can see and compare the figures. What do you think? John: Ive never really thought about it like that before. I guess we could put the operating cash flow per share on the income statement, underneath the earnings per share amount. Users would really benefit from this disclosure. Thanks for the ideaIll start working on it. Lucas: Glad to be of service. How would you interpret this situation? Is John behaving in an ethical and professional manner?arrow_forwardSuppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Ratios Calculated Year 1 Year 2 1.00 1.30 2.40 Inventory turnover 2.00 Debt-to-equity Price-to-cash-flow Year 3 1.46 2.69 0.30 0.32 0.38 Based on the preceding Information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. Cold Goose Metal Works Inc.'s ability to meet its debt obligations has worsened since its debt-to-equity ratio Increased from 0.30 to 0.38. The company's creditworthiness has improved over these…arrow_forwardLast year Roussakis Company's operations provided a negative net cash flow, yet the cash shown on its balance sheet increased. What action could explain the increase in cash, assuming the company's financial statements were prepared under IFRS? a. The company repurchased some of its common stock. O b. The company retired a large amount of its long-term debt. O c. The company sold some of its fixed assets. O d. The company had high depreciation expenses.arrow_forward

- Please give a detailed analysis of the financial statements given below for Joshua & White Technologies. Your analysis should include answers to the questions as follows (not limited to these questions): Has the company’s liquidity position improved or worsened? Has the company’s ability to manage its assets improved or worsened? How has the company’s profitability changed during the last year? Joshua & White Technologies: December 31 Balance Sheets (Thousands of Dollars) Assets 2019 2018 Cash and cash equivalents $21,000 $20,000 Short-term investments 3,759 3,240 Accounts Receivable 52,500 48,000 Inventories 84,000 56,000 Total current assets $161,259 $127,240 Net fixed assets 223,097 200,000 Total assets $384,356 $327,240 Liabilities and equity Accounts payable $33,600 $32,000 Accruals 12,600 12,000…arrow_forwardWhich of the following usually is least important as a measure of short-term liquidity? Choose Quick ratio. ifficult of the following items to predict Current ratio. Debt ratio. Cash flows from operating activities. porod first?arrow_forwardLast year, National Co. reported negative net cash flow and negative free cash flow. However, its cash on the balance sheet increased. Which of the following could explain these changes in its cash position? a. The company had a sharp increase in its depreciation and amortization expenses. b. The company had a sharp increase in its inventories. c. The company issued new common stock. d. None of the choicesarrow_forward

- Lucas Hunter, president of Simmons Industries Inc., believes that reporting operating cash flow per share on the income statement would be a useful addition to the company’s just completed financial statements. The following discussion took place between Lucas Hunter and Simmons’ controller, John Jameson, in January, after the close of the fiscal year:Lucas: I’ve been reviewing our financial statements for the last year. I am disappointed that our net income per share has dropped by 10% from last year. This won’t look good to our shareholders. Is there anything we can do about this?John: What do you mean? The past is the past, and the numbers are in. There isn’t much that can be done about it. Our financial statements were prepared according to generally accepted accounting principles, and I don’t see much leeway for significant change at this point.Lucas: No, no. I’m not suggesting that we “cook the books.” But look at the cash flow from operating activities on the statement of cash…arrow_forwardThe company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company’s relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Ratios Calculated Year 1 Year 2 Year 3 Price-to-cash-flow 2.80 1.96 1.57 Inventory turnover 5.60 4.48 3.58 Debt-to-equity 0.60 0.48 0.38 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. A plausible reason why Blue Hamster Manufacturing Inc.’s price-to-cash-flow ratio has decreased is that investors expect lower cash flow per share in the future. Blue Hamster Manufacturing Inc.’s ability to meet its debt obligations has improved since its debt-to-equity ratio…arrow_forwardConsider the case of Hungry Whale Electronics Company: Hungry Whale Electronics Company is a mature firm that has a stable flow of business. The following data was taken from its financial statements last year: Annual sales $10,500,000 Cost of goods sold $6,825,000 Inventory $3,100,000 Accounts receivable $1,900,000 Accounts payable $2,400,000 Hungry Whale’s CFO is interested in determining the length of time funds are tied up in working capital. Use the information in the preceding table to complete the following table. (Note: Use 365 days as the length of a year in all calculations, and round all values to two decimal places.) Value Inventory Conversion Period Average collection period Payables Deferral Period Cash conversion cycle Both the inventory conversion period and payables deferral period use the average daily COGS in their denominators, whereas the average collection period uses average daily sales in…arrow_forward

- The management of Bridgeport Inc. is trying to decide whether it can increase its dividend. During the current year, it reported net income of $870,300. It had net cash provided by operating activities of $643.900, paid cash dividends of $76,200, and had capital expenditures of $278,200. (a1) Compute the company's free cash flow. (Enter negative amount using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Free cash flow tAarrow_forwardMary Walker, president of Rusco Company, considers $22,000 to be the minimum cash balance for operating purposes. As can be seen from the following statements, only $17,000 in cash was available at the end of this year. Since the company reported a large net income for the year, and also issued both bonds and common stock, the sharp decline in cash is puzzling to Ms. Walker. Assets Current assets: Cash Accounts receivable Inventory Prepaid expenses Total current assets Long-term investments Plant and equipment Less accumulated depreciation Net plant and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Rusco Company Comparative Balance Sheet at July 31 Income taxes payable Total current liabilities Bonds payable Total liabilities. Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Rusco Company Income Statement For This Year Ended July 31 Sales…arrow_forward• Last year, J&H Corp. reported a book value of $700 million in current assets, of which 15% is cash, 17% is short-term investments, and the rest is accounts receivable and inventory. • The company reported $595.0 million of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period. • The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $1,120 million in long-term assets last year. Income Statement For the Year Ended on December 31 (Millions of dollars) J&H Corp. $1,500 1,200 60 Net sales Operating costs, except depreciation and amortization Depreciation and amortization Total operating costs Operating income (or EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes (40%) Net income 1,260 $240 24 $216 86 $130 Industry Average $1,875 1,500 75 1,575 $300 45 $255 102 $153 Based…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License